Your What is a tropical cyclone deductible images are available. What is a tropical cyclone deductible are a topic that is being searched for and liked by netizens today. You can Get the What is a tropical cyclone deductible files here. Find and Download all royalty-free photos.

If you’re looking for what is a tropical cyclone deductible pictures information related to the what is a tropical cyclone deductible keyword, you have pay a visit to the right site. Our site frequently provides you with suggestions for viewing the maximum quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

What Is A Tropical Cyclone Deductible. When is the hurricane deductible applicable. A hurricane or a storm deductible means that instead of paying a typical 500 or 1000 deductible homeowners are on the hook for 1 or 2 of the insured value of a home or even as high as 10. That percentage along with details about a policys hurricane deductible usually appears on. Any category 1-5 hurricane would fall under this deductible.

Hurricanes Katrina And Rita Coverage Disputes And Pending Litigation Expert Commentary Irmi Com From irmi.com

Hurricanes Katrina And Rita Coverage Disputes And Pending Litigation Expert Commentary Irmi Com From irmi.com

Some homeowners insurance policies have specific deductibles for damage caused by windstorms and hail or by tropical cyclones or hurricanes. A named storm deductible in addition to applying to categorized hurricanes also applies to a weather event declared such as a typhoon tropical storm or a tropical cyclone by the US. Some states require at least a Cat 2 hurricane for the hurricane deductible to be activated. National Hurricane Center and where a number or name has been applied eg Hurricane Andrew Superstorm Sandy etc. Triggers vary by state and insurance company and the specifics of how your hurricane deductible works will be explained in your policy. The hurricane deductible applies only once during a hurricane season.

Thunderstorm activity and definite cyclonic surface wind circulation Holland 1993.

Some homeowners insurance policies have specific deductibles for damage caused by windstorms and hail or by tropical cyclones or hurricanes. These deductibles apply whenever damage is caused by wind. But in many hurricane-prone states insurance companies apply a separate higher deductible for wind damage caused by a hurricane or named storm. You may be able to adjust the amount of your. Your hurricane deductible kicks in once the criteria have been met for the insurance company to trigger it. The typical hurricane deductible is between 1 and 5 of the homes insured value although policies in some vulnerable coastal areas could have.

Source: munichre.com

Source: munichre.com

These deductibles apply whenever damage is caused by wind. Thunderstorm activity and definite cyclonic surface wind circulation Holland 1993. A named storm deductible in addition to applying to categorized hurricanes also applies to a weather event declared such as a typhoon tropical storm or a tropical cyclone by the US. The broadest of these three meaning where it will apply to the most consumer claims is a Windstorm deductible. That percentage along with details about a policys hurricane deductible usually appears on.

Source: worldvision.org

Source: worldvision.org

By Florida law property insurance rate filings must include mitigation discounts or credits. The percentages are based on the total value of the home. Triggers vary by state and insurance company and the specifics of how your hurricane deductible works will be explained in your policy. But in many hurricane-prone states insurance companies apply a separate higher deductible for wind damage caused by a hurricane or named storm. The timing of when a hurricane is.

Source: corporatesolutions.swissre.com

Source: corporatesolutions.swissre.com

A hurricane or a storm deductible means that instead of paying a typical 500 or 1000 deductible homeowners are on the hook for 1 or 2 of the insured value of a home or even as high as 10. Type of Deductible. Example 200000 house with a 3 named storm deductible would result in a wind claim subject to a 6000 deductible as a result of a Named Storm. By Florida law property insurance rate filings must include mitigation discounts or credits. The ADC is a special feature of CCRIFs tropical cyclone TC and earthquake EQ parametric insurance policies.

Source: harrylevineinsurance.com

Source: harrylevineinsurance.com

While a regular homeowners insurance policy deductible is a fixed dollar amountsay 500 or 2000a hurricane deductible might be 2 to 5 percent of a homes insured value or 2000 to. Some homeowners insurance policies have specific deductibles for damage caused by windstorms and hail or by tropical cyclones or hurricanes. That is when your hurricane deductible would be applicable. Hurricane deductibles are calculated as a percentage of the insured value of a house. A tropical cyclone is the generic term for a non-frontal synoptic scale low-pressure system over tropical or sub-tropical waters with organized convection ie.

Source: nl.pinterest.com

Source: nl.pinterest.com

The percentages are based on the total value of the home. Hurricane deductibles are what you pay for home repairs after hurricane damage and are usually higher much higher than a regular. Your deductible is the amount you pay out of pocket before your insurance kicks in to help pay for a covered claim. Some states require at least a Cat 2 hurricane for the hurricane deductible to be activated. Hurricane Deductible - if a hurricane damages your property use this deductible.

Source: insuranceresourcesllc.com

Source: insuranceresourcesllc.com

The hurricane deductible applies only once during a hurricane season. Insurance policies covering property along the coastline may contain what is called a hurricane deductible or named storm deductible or even Tropical Cyclone deductible and it may come into play in the event of a storm under specific circumstances. But in many hurricane-prone states insurance companies apply a separate higher deductible for wind damage caused by a hurricane or named storm. National Hurricane Center and where a number or name has been applied eg Hurricane Andrew Superstorm Sandy etc. Damage that is caused by wind during particular weather conditions or timeframe will trigger your hurricane deductible.

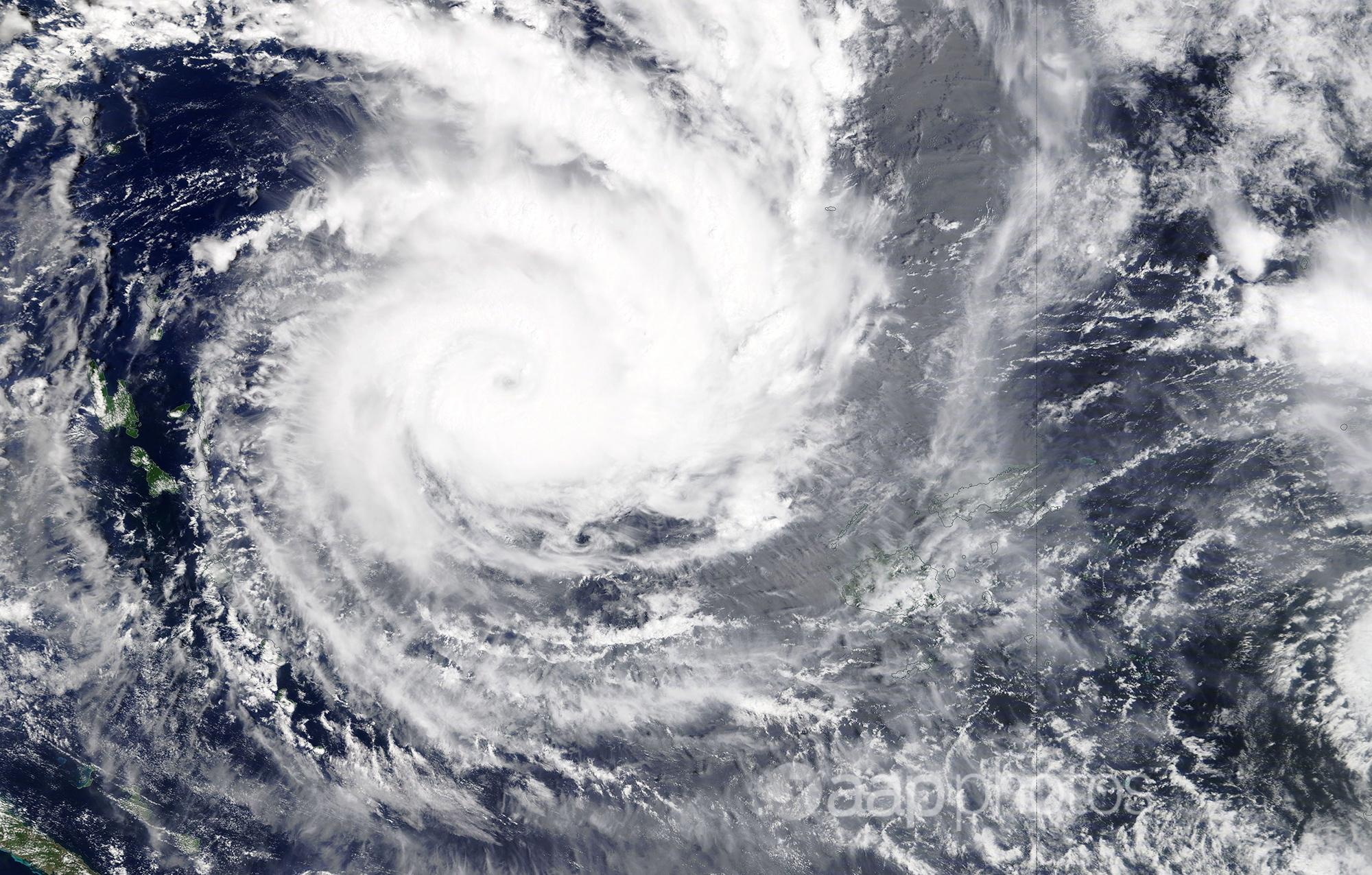

Source: aap.com.au

Source: aap.com.au

The most common Named Storm deductibles are 1 2 3 or 5. These deductibles apply whenever damage is caused by wind. Insurance policies covering property along the coastline may contain what is called a hurricane deductible or named storm deductible or even Tropical Cyclone deductible and it may come into play in the event of a storm under specific circumstances. Thunderstorm activity and definite cyclonic surface wind circulation Holland 1993. All insurers must offer a hurricane deductible of 500 2 percent 5 percent and 10 percent of the policy dwelling or structure limits.

Source: forbes.com

Source: forbes.com

Some states require at least a Cat 2 hurricane for the hurricane deductible to be activated. That is when your hurricane deductible would be applicable. Your deductibles are listed in your homeowners insurance policy. Any loss must have. Hurricane deductibles are calculated as a percentage of the insured value of a house.

Source: researchgate.net

Source: researchgate.net

2 There is an all perils deductible which is typically expressed as a flat dollar amount such as 500 or 1000 and there is a wind hurricane or tropical cyclone deductible which is typically a fixed dollar deductible or expressed as a percentage of the insured valuecommonly up to 5. But in many hurricane-prone states insurance companies apply a separate higher deductible for wind damage caused by a hurricane or named storm. These deductibles apply whenever damage is caused by wind. National Weather Service or the US. A tropical cyclone is the generic term for a non-frontal synoptic scale low-pressure system over tropical or sub-tropical waters with organized convection ie.

Source: climada-python.readthedocs.io

Source: climada-python.readthedocs.io

National Hurricane Center and where a number or name has been applied eg Hurricane Andrew Superstorm Sandy etc. The typical hurricane deductible is between 1 and 5 of the homes insured value although policies in some vulnerable coastal areas could have. Your deductibles are listed in your homeowners insurance policy. Thunderstorm activity and definite cyclonic surface wind circulation Holland 1993. Some homeowners insurance policies have specific deductibles for damage caused by windstorms and hail or by tropical cyclones or hurricanes.

Source: earthjustice.org

Source: earthjustice.org

There are two common types of deductibles for property policies. A hurricane is a cyclone with winds upwards of 74 miles per hour which included rain thunder and lightning. 2 There is an all perils deductible which is typically expressed as a flat dollar amount such as 500 or 1000 and there is a wind hurricane or tropical cyclone deductible which is typically a fixed dollar deductible or expressed as a percentage of the insured valuecommonly up to 5. Some states require at least a Cat 2 hurricane for the hurricane deductible to be activated. The timing of when a hurricane is.

Source: thompsoncoe.com

Source: thompsoncoe.com

A hurricane must have sustained winds at 74 mph or more to be at least a Category 1 Hurricane. Hurricane deductibles are calculated as a percentage of the insured value of a house. 2 There is an all perils deductible which is typically expressed as a flat dollar amount such as 500 or 1000 and there is a wind hurricane or tropical cyclone deductible which is typically a fixed dollar deductible or expressed as a percentage of the insured valuecommonly up to 5. You may be able to adjust the amount of your. Your hurricane deductible kicks in once the criteria have been met for the insurance company to trigger it.

Source: pinterest.com

Source: pinterest.com

A hurricane or a storm deductible means that instead of paying a typical 500 or 1000 deductible homeowners are on the hook for 1 or 2 of the insured value of a home or even as high as 10. National Hurricane Center and where a number or name has been applied eg Hurricane Andrew Superstorm Sandy etc. But in many hurricane-prone states insurance companies apply a separate higher deductible for wind damage caused by a hurricane or named storm. The percentages are based on the total value of the home. The most common Named Storm deductibles are 1 2 3 or 5.

Source: climada-python.readthedocs.io

Source: climada-python.readthedocs.io

The ADC was designed to potentially provide a payment for TC and EQ events that are objectively not sufficient to trigger the countrys main policy because the modelled loss is below the policy attachment point which is similar to a deductible. The most common Named Storm deductibles are 1 2 3 or 5. By Florida law property insurance rate filings must include mitigation discounts or credits. Example 200000 house with a 3 named storm deductible would result in a wind claim subject to a 6000 deductible as a result of a Named Storm. The ADC was designed to potentially provide a payment for TC and EQ events that are objectively not sufficient to trigger the countrys main policy because the modelled loss is below the policy attachment point which is similar to a deductible.

Source: in.pinterest.com

Source: in.pinterest.com

A named storm deductible in addition to applying to categorized hurricanes also applies to a weather event declared such as a typhoon tropical storm or a tropical cyclone by the US. By Florida law property insurance rate filings must include mitigation discounts or credits. This deductible is only triggered if damaged is sustained from a named tropical storm or a hurricane. You may be able to adjust the amount of your. These deductibles apply whenever damage is caused by wind.

Source: pinterest.com

Source: pinterest.com

But in many hurricane-prone states insurance companies apply a separate higher deductible for wind damage caused by a hurricane or named storm. Insurance policies covering property along the coastline may contain what is called a hurricane deductible or named storm deductible or even Tropical Cyclone deductible and it may come into play in the event of a storm under specific circumstances. A hurricane must have sustained winds at 74 mph or more to be at least a Category 1 Hurricane. But in many hurricane-prone states insurance companies apply a separate higher deductible for wind damage caused by a hurricane or named storm. The ADC is a special feature of CCRIFs tropical cyclone TC and earthquake EQ parametric insurance policies.

Source: climada-python.readthedocs.io

Source: climada-python.readthedocs.io

National Weather Service or the US. Thunderstorm activity and definite cyclonic surface wind circulation Holland 1993. The most common Named Storm deductibles are 1 2 3 or 5. That percentage along with details about a policys hurricane deductible usually appears on. There are two common types of deductibles for property policies.

Source: munichre.com

Source: munichre.com

That percentage along with details about a policys hurricane deductible usually appears on. A tropical cyclone is the generic term for a non-frontal synoptic scale low-pressure system over tropical or sub-tropical waters with organized convection ie. These include not only hurricanes and other tropical storms but also winter noreasters and summer thunderstorms. Your hurricane deductible is normally listed as a percentage usually 1 to 5 of your propertys insurance value. The ADC is a special feature of CCRIFs tropical cyclone TC and earthquake EQ parametric insurance policies.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is a tropical cyclone deductible by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.