Your Savannah ga county sales tax rate images are ready in this website. Savannah ga county sales tax rate are a topic that is being searched for and liked by netizens today. You can Find and Download the Savannah ga county sales tax rate files here. Find and Download all royalty-free vectors.

If you’re looking for savannah ga county sales tax rate pictures information linked to the savannah ga county sales tax rate topic, you have come to the ideal blog. Our website always provides you with hints for downloading the maximum quality video and picture content, please kindly hunt and find more informative video content and images that fit your interests.

Savannah Ga County Sales Tax Rate. The combined rate used in this calculator 7 is the result of the Georgia state rate 4 the 31419s county rate 3. Did South Dakota v. 38000 x 128561000 48853 final City tax bill amount Or 38000 x 01285648853. Some cities and local governments in Chatham County collect additional local sales taxes which can be as high as 88817841970013E-16.

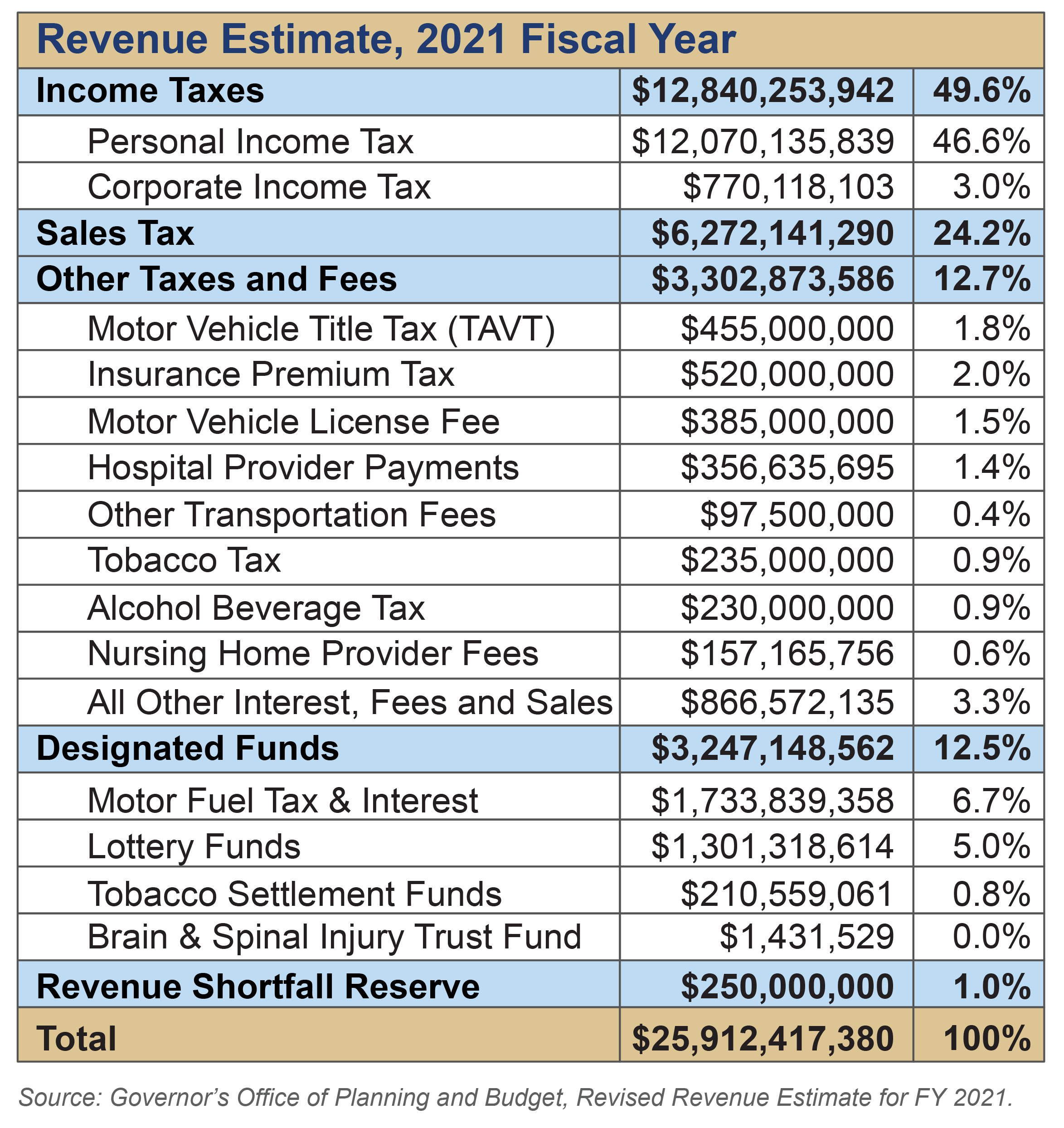

Georgia Sales Tax Small Business Guide Truic From howtostartanllc.com

Georgia Sales Tax Small Business Guide Truic From howtostartanllc.com

31405 zip code sales tax and use tax rate Savannah Chatham County Georgia. Sales Tax and Use Tax Rate of Zip Code 31405 is located in Savannah City Chatham County Georgia StateTax Risk level. 694 rows Georgia has state sales tax of 4 and allows local governments to collect a local. The Savannah sales tax rate is. Sales Tax and Use Tax Rate of Zip Code 31416 is located in Savannah City Chatham County Georgia StateTax Risk level. 31411 zip code sales tax and use tax rate Savannah Chatham County Georgia.

The minimum combined 2021 sales tax rate for Savannah Georgia is.

The 31419 Savannah Georgia general sales tax rate is 7. Ex-Officio Sheriffs Deed Sales. Rate Changes Effective January 1 2022 5215 KB Rate Changes Effective October 1 2021 5244 KB Rate Changes Effective July 1 2021 5278 KB Rate Changes Effective April 1 2021 5436 KB Rate Changes Effective January 1 2021 5216 KB Rate Changes Effective October 1 2020 - UPDATED 18Sep2020 5695 KB. Sales Tax and Use Tax Rate of Zip Code 31419 is located in Savannah City Chatham County Georgia StateTax Risk level. The minimum combined 2021 sales tax rate for Savannah Georgia is. Locally the School Board and Chatham County set and assess property taxes separately and in addition to the tax.

Source: avalara.com

Source: avalara.com

Rate Changes Effective January 1 2022 5215 KB Rate Changes Effective October 1 2021 5244 KB Rate Changes Effective July 1 2021 5278 KB Rate Changes Effective April 1 2021 5436 KB Rate Changes Effective January 1 2021 5216 KB Rate Changes Effective October 1 2020 - UPDATED 18Sep2020 5695 KB. We will begin with the Judicial Sale. The minimum combined 2021 sales tax rate for Savannah Georgia is. The City of Savannahs 2019 millage rate is 12856 which means property owners pay 12856 per 1000 of taxable value. Our tax sales are held in in front of the Chatham County Courthouse at 133 Montgomery Street Savannah Georgia on the first Tuesday of the month at 1000 am.

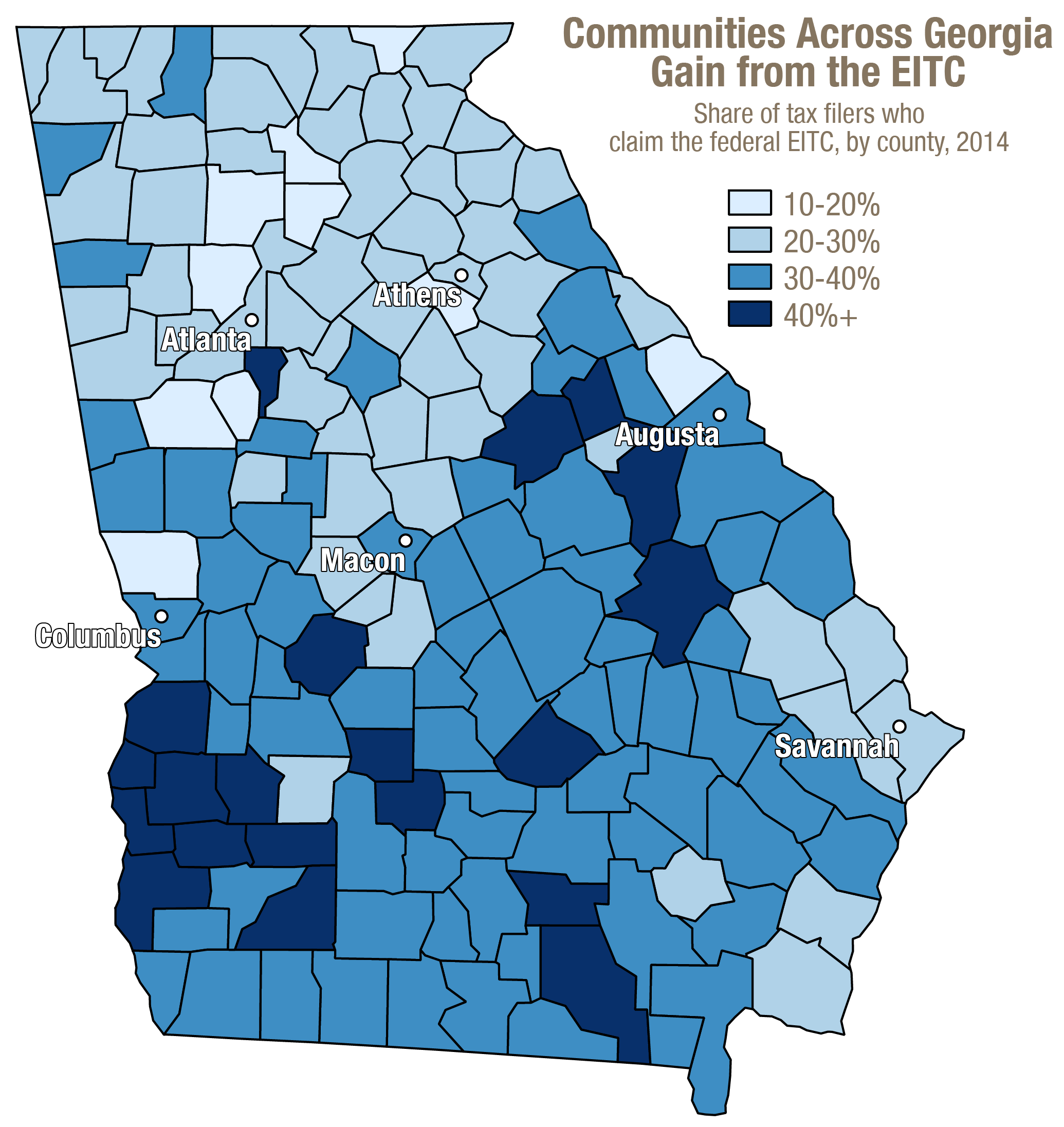

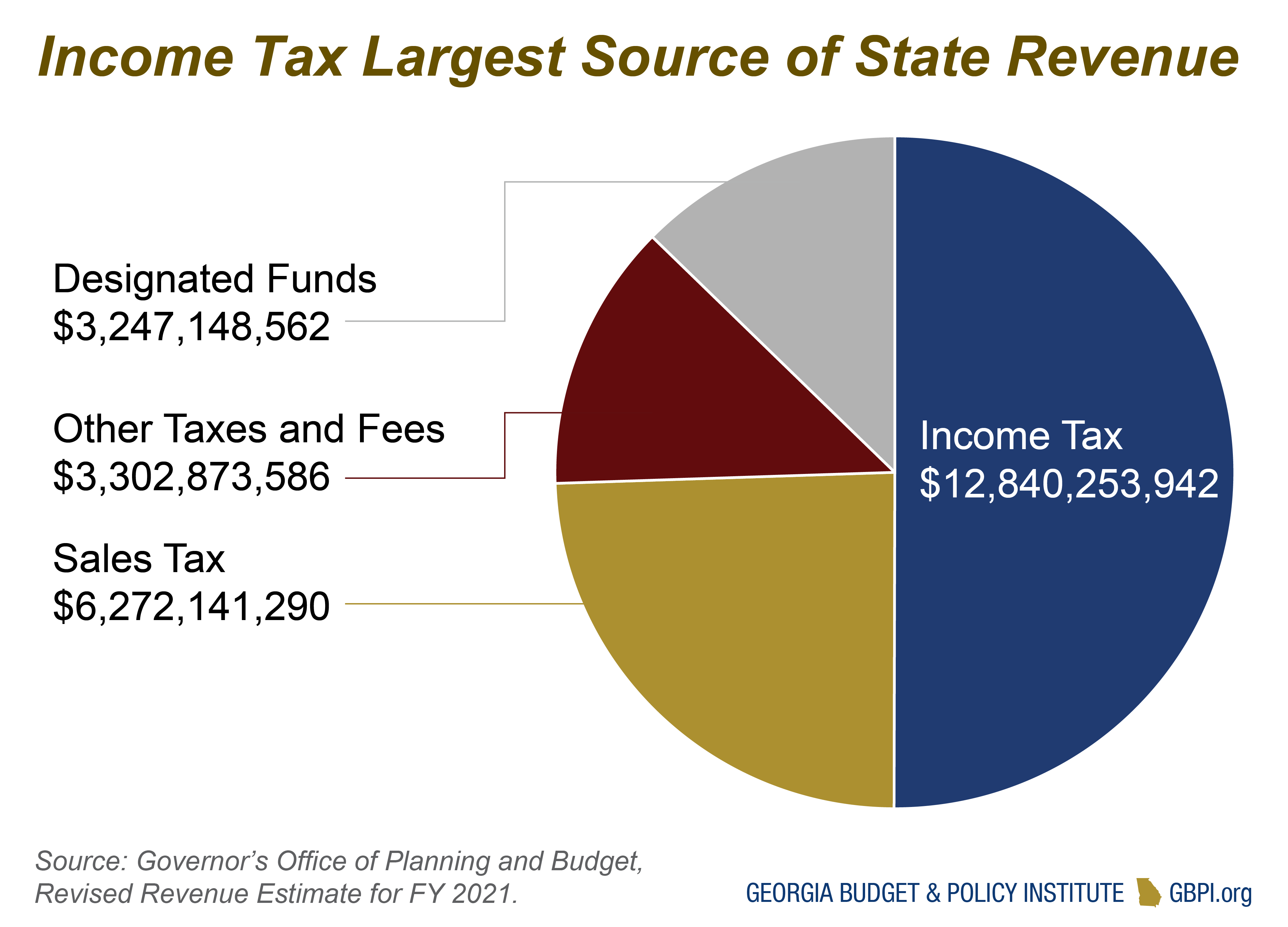

Source: gbpi.org

Source: gbpi.org

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Savannah GA at tax lien auctions or online distressed asset sales. We will begin with the Judicial Sale. Sales Tax and Use Tax Rate of Zip Code 31405 is located in Savannah City Chatham County Georgia StateTax Risk level. 2 State Sales tax is 400Rank 41Estimated Combined Tax Rate 700 Estimated County Tax Rate 300 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and. Wayfair Inc affect Georgia.

Source: salesandusetax.com

Source: salesandusetax.com

Sales Tax and Use Tax Rate of Zip Code 31419 is located in Savannah City Chatham County Georgia StateTax Risk level. In addition to the local hotelmotel tax the 7 State Use and Sales Tax must be remitted to the Georgia Revenue Department by the 20th day of the following month. This is 5 lower -3891 than the average tugboat captain salary in the United States. The Chatham County Sales Tax is 3. 1 State Sales tax is 400Rank 41Estimated Combined Tax Rate 700 Estimated County Tax Rate 300 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and.

Source: gbpi.org

Source: gbpi.org

State Use And Sales Tax. The City of Savannahs 2019 millage rate is 12856 which means property owners pay 12856 per 1000 of taxable value. Savannah GA currently has 714 tax liens available as of January 4. 38000 x 128561000 48853 final City tax bill amount Or 38000 x 01285648853. 222 W Oglethorpe Ave 107 Savannah Georgia 31401 912 652-7100 912 652-7101.

Source: everquote.com

Source: everquote.com

There is no applicable city tax or special tax. If payments are more than 500 only electronic submissions will be accepted. Our tax sales are held in in front of the Chatham County Courthouse at 133 Montgomery Street Savannah Georgia on the first Tuesday of the month at 1000 am. Savannah GA currently has 714 tax liens available as of January 4. The 31419 Savannah Georgia general sales tax rate is 7.

Source: intuitiveaccountant.com

Source: intuitiveaccountant.com

These buyers bid for an interest rate on the taxes owed and the right to collect back that. Depending on the zipcode the sales tax rate of Savannah may vary from 4 to 7 4 is the smallest possible tax rate 31422 Savannah Georgia 7 is the highest possible tax rate 31401 Savannah Georgia. The Savannah sales tax rate is. This is 5 lower -3891 than the average tugboat captain salary in the United States. The minimum combined 2021 sales tax rate for Savannah Georgia is.

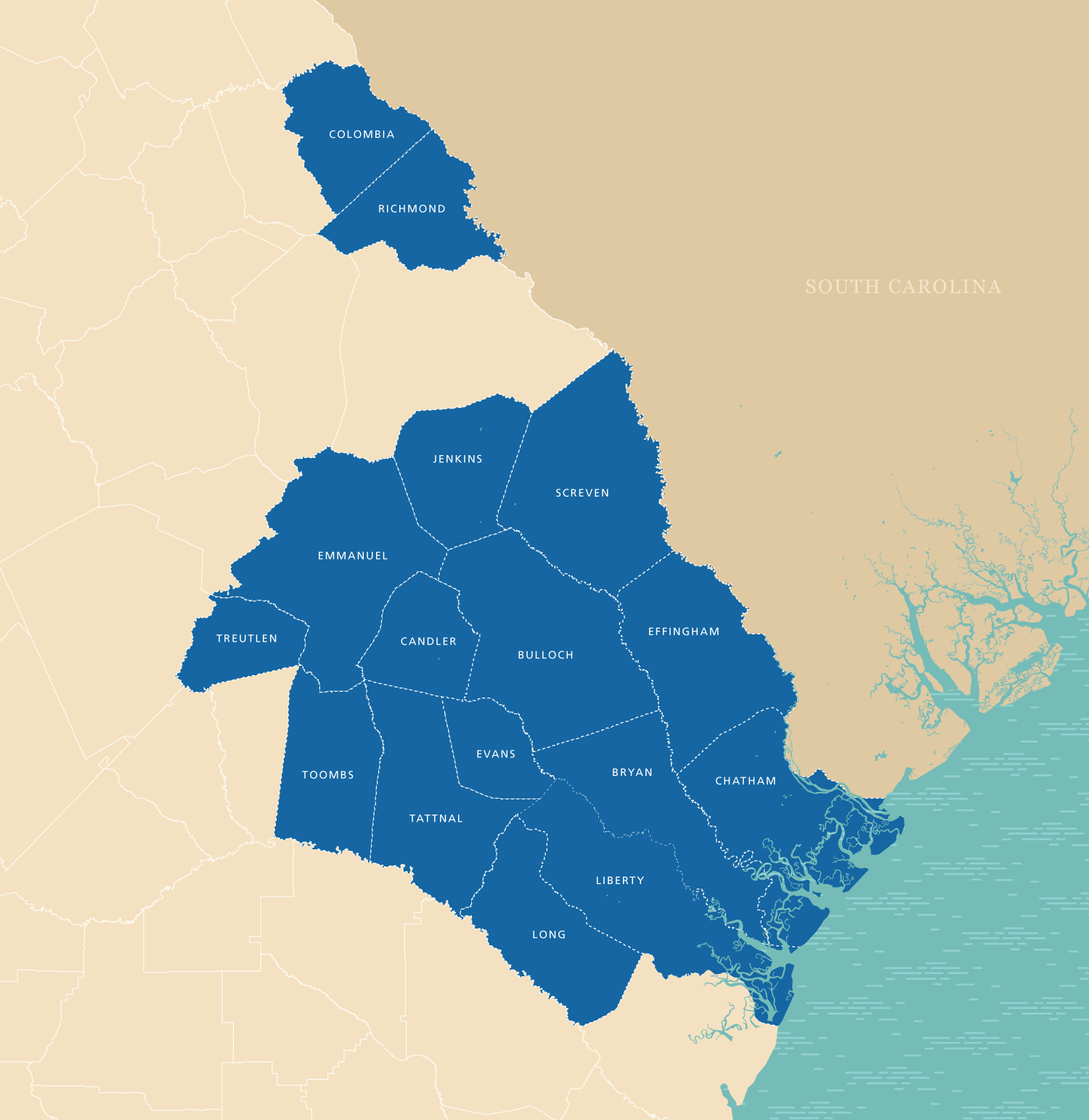

Source: coastalcourier.com

Source: coastalcourier.com

Savannah GA currently has 714 tax liens available as of January 4. Savannah City Council unanimously passes 2022 budget. In addition to the local hotelmotel tax the 7 State Use and Sales Tax must be remitted to the Georgia Revenue Department by the 20th day of the following month. This is the total of state county and city sales tax rates. The Chatham County Sales Tax is 3.

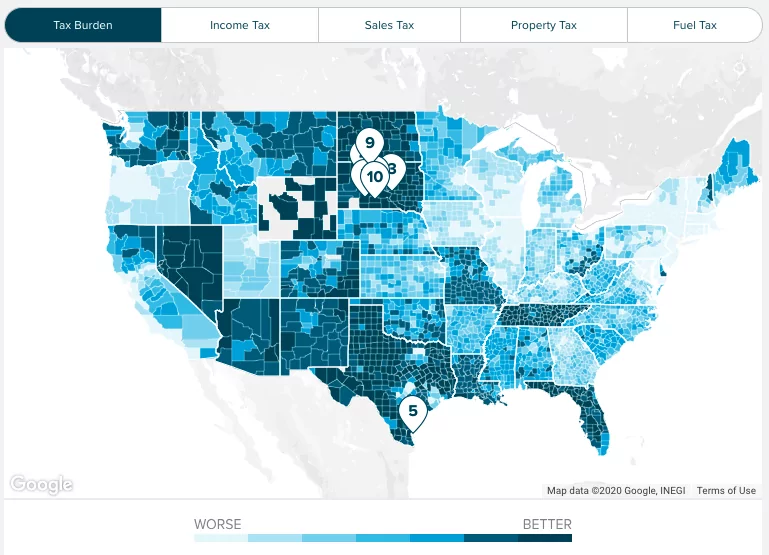

Source: smartasset.com

Source: smartasset.com

We will begin with the Judicial Sale. Savannah GA currently has 714 tax liens available as of January 4. 31419 zip code sales tax and use tax rate Savannah Chatham County Georgia. The 479 million proposed budget delivers high-quality and improved services while making investments to improve the lives of residents with major investments in housing and improving. 305 Fahm Street Savannah GA 31401.

These buyers bid for an interest rate on the taxes owed and the right to collect back that. The 7 sales tax rate in Savannah consists of 4 Georgia state sales tax and 3 Chatham County sales tax. 2 State Sales tax is 400Rank 41Estimated Combined Tax Rate 700 Estimated County Tax Rate 300 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and. 305 Fahm Street Savannah GA 31401. Some cities and local governments in Chatham County collect additional local sales taxes which can be as high as 88817841970013E-16.

Source: seda.org

Source: seda.org

Some cities and local governments in Chatham County collect additional local sales taxes which can be as high as 88817841970013E-16. Depending on the zipcode the sales tax rate of Savannah may vary from 4 to 7 4 is the smallest possible tax rate 31422 Savannah Georgia 7 is the highest possible tax rate 31401 Savannah Georgia. Wayfair Inc affect Georgia. The 31419 Savannah Georgia general sales tax rate is 7. Our tax sales are held in in front of the Chatham County Courthouse at 133 Montgomery Street Savannah Georgia on the first Tuesday of the month at 1000 am.

Source: avalara.com

Source: avalara.com

In addition to the local hotelmotel tax the 7 State Use and Sales Tax must be remitted to the Georgia Revenue Department by the 20th day of the following month. Rate variation The 31419s tax rate may change depending of the type of purchase. This is 5 lower -3891 than the average tugboat captain salary in the United States. This is the total of state county and city sales tax rates. If payments are more than 500 only electronic submissions will be accepted.

Source: smartasset.com

Source: smartasset.com

Some cities and local governments in Chatham County collect additional local sales taxes which can be as high as 88817841970013E-16. The City of Savannahs 2019 millage rate is 12856 which means property owners pay 12856 per 1000 of taxable value. You can print a 7 sales tax table here. To pay online you will need to Sign Up and Create My User Name. Depending on the zipcode the sales tax rate of Savannah may vary from 4 to 7 4 is the smallest possible tax rate 31422 Savannah Georgia 7 is the highest possible tax rate 31401 Savannah Georgia.

Source: pinterest.com

Source: pinterest.com

A county-wide sales tax rate of 3 is applicable to localities in Chatham County in addition to the 4 Georgia sales tax. Chatham County Georgia Sales Tax Rate 2021 Up to 7. The City of Savannahs 2019 millage rate is 12856 which means property owners pay 12856 per 1000 of taxable value. Depending on the zipcode the sales tax rate of Savannah may vary from 4 to 7 4 is the smallest possible tax rate 31422 Savannah Georgia 7 is the highest possible tax rate 31401 Savannah Georgia. 305 Fahm Street Savannah GA 31401.

Source: howtostartanllc.com

Source: howtostartanllc.com

694 rows Georgia has state sales tax of 4 and allows local governments to collect a local. This is the total of state county and city sales tax rates. How 2021 Sales taxes are calculated for zip code 31419. 1 State Sales tax is 400Rank 41Estimated Combined Tax Rate 700 Estimated County Tax Rate 300 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and. You can print a 7 sales tax table here.

Source: reddit.com

Source: reddit.com

Sales Tax and Use Tax Rate of Zip Code 31416 is located in Savannah City Chatham County Georgia StateTax Risk level. Savannah GA currently has 714 tax liens available as of January 4. Ex-Officio Sheriffs Deed Sales. 1 State Sales tax is 400Rank 41Estimated Combined Tax Rate 700 Estimated County Tax Rate 300 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and. Sales Tax and Use Tax Rate of Zip Code 31411 is located in Savannah City Chatham County Georgia StateTax Risk level.

Source: blog.directauto.com

Source: blog.directauto.com

State Use And Sales Tax. The Georgia sales tax rate is currently. There is no city sale tax for Savannah. Make Appointment 844-545-5640 I agree that taxes are cheaper in. 31411 zip code sales tax and use tax rate Savannah Chatham County Georgia.

Source: gbpi.org

Source: gbpi.org

Some cities and local governments in Chatham County collect additional local sales taxes which can be as high as 88817841970013E-16. The Savannah sales tax rate is. Savannah City Council unanimously passes 2022 budget. In addition to the local hotelmotel tax the 7 State Use and Sales Tax must be remitted to the Georgia Revenue Department by the 20th day of the following month. Our tax sales are held in in front of the Chatham County Courthouse at 133 Montgomery Street Savannah Georgia on the first Tuesday of the month at 1000 am.

Source: accuratetax.com

Source: accuratetax.com

38000 x 128561000 48853 final City tax bill amount Or 38000 x 01285648853. Sales Tax and Use Tax Rate of Zip Code 31411 is located in Savannah City Chatham County Georgia StateTax Risk level. 2 State Sales tax is 400Rank 41Estimated Combined Tax Rate 700 Estimated County Tax Rate 300 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and. Our tax sales are held in in front of the Chatham County Courthouse at 133 Montgomery Street Savannah Georgia on the first Tuesday of the month at 1000 am. Sales Tax and Use Tax Rate of Zip Code 31416 is located in Savannah City Chatham County Georgia StateTax Risk level.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title savannah ga county sales tax rate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.